Selection from the article:

“For Series A you have to think about who are the investors that you want on board. You need to already be having that dialogue six to nine months before you go out to fundraise” —Christina Caljé

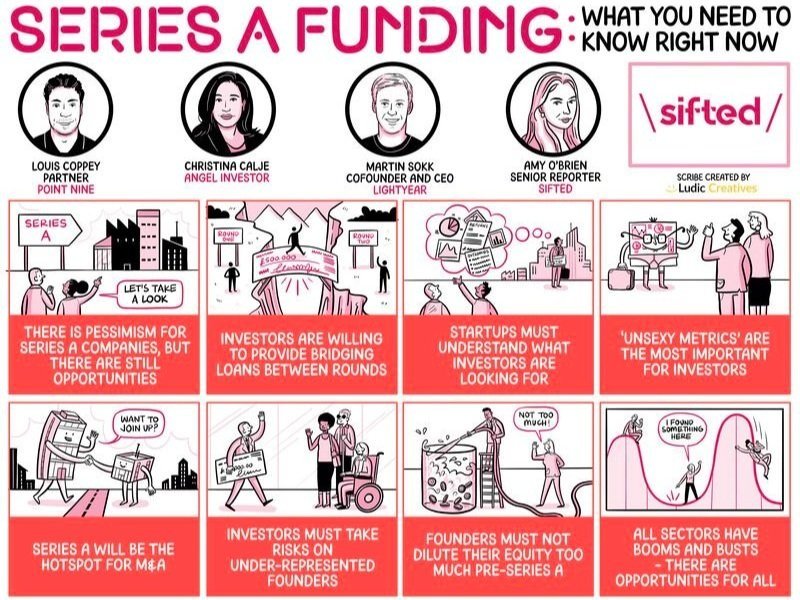

1/ There is pessimism for Series A companies, but there are still opportunities

2/ Understand what investors are looking for before fundraising

Caljé spoke about the challenges facing angel investors and VCs in today’s market. She said that many angels are having to reach out to their networks to help companies with their runway between rounds, but that investors are willing to do so in order to keep their investments afloat.

Coppey said startups have to assess their viability as a late-stage company much earlier, taking collaborative discussions with their investors to see if they’ll be able to scale, something which might not have happened until a Series B round during the boom period.

Given this environment, Caljé said it's important for startups to understand the milestones investors are looking for before they seek out Series A investment.

3/ ‘Unsexy numbers’ are the most important KPIs for investors

4/ Valuations are lower, but that’s ok

5/ Investors must take risks on under-represented founders

Both Caljé and Coppey suggested investors will fall back on their networks for investments during a lean period. This could lead to serial entrepreneurs getting the benefit of the doubt over less experienced peers.

For this reason, founders from under-represented groups often have to bootstrap for longer, Caljé said. Coppey said that the onus is on investors to still take risks on founders from all backgrounds, and that downturns present a great opportunity to level the playing field.